Where You will find there's rejected or unissued TIN, on the other hand, you will desire to follow up with the vendor to collect the proper information. You may use our W-nine e-Solicitation to gather the updated information. Running the B-Recognize system with us permits you to manage all of your appropriate vendor information in a single area.

Accounting software is actually a Instrument that helps businesses regulate and automate their economical processes. It may possibly perform An array of features, like:

All three will have to match to acquire a “pass” or you’re alerted from the error. Avalara lets you recheck a Formerly failed TIN at no extra cost.

Charitable donations–Only donations to qualified charities can qualify as tax deductions. Handouts towards the homeless or payments to local organizations that aren't classified as non-revenue from the IRS cannot be deducted.

Contrary to adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which suggests the amount of tax that you just owe.

Therefore employers withhold income from employee earnings to pay for taxes. These here taxes include Social Security tax, income tax, Medicare tax and other state income taxes that gain W-2 employees.

You would possibly get Form 1099-OID if you acquire bonds, notes or other fiscal instruments in a discount into the encounter price or redemption worth at maturity. Generally, the instrument need to have a maturity of extra than just one year.

There are many varieties of 1099 tax forms. The IRS also refers to them as "information returns." Right here’s a primary rundown from the Form 1099s most probably to cross your path.

We take pleasure in your comprehension and therefore are dedicated to resolving this challenge at the earliest opportunity so we can detect a means for all customers’ W-two’s being filed before the January 31st filing deadline.

Be prepared to present your name, Social Security number, and place in the corporate. The operator needs to verify that you're entitled into the information just before they offer it to you.

Travel benefits credit cards0% APR credit cardsCash back again credit cardsBusiness credit cardsAirline credit cardsHotel credit cardsStudent credit cardsStore credit cards

This refers to the amount of federal and state taxes which are taken out of your paycheck by your employer throughout the year. Keeper assumes a standard withholding by default. If you know your employer's correct withholding, you could enter it beneath "Include Sophisticated info".

You're currently viewing a placeholder information from X. To accessibility the particular articles, click the button underneath. Remember to note that doing this will share information with 3rd-get together vendors.

Automobile insurance guideCompare vehicle insurance ratesBest automobile insurance companiesCheapest car insurancePolicies and coverageAuto insurance reviews

Jaleel White Then & Now!

Jaleel White Then & Now! Rick Moranis Then & Now!

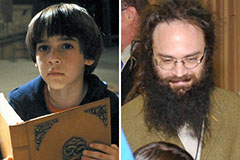

Rick Moranis Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now!